Discover opportunities for better outcomes with Luminos RMIS

Managing a successful claims and risk management program requires having the right information to make quality decisions. Through our partnership with Origami Risk, Gallagher Bassett has created a unique hybrid RMIS for our clients, carriers, and broker partners.

Alongside core software features, we utilize our claims expertise and internal data science resources to integrate select proprietary computing tools into our Luminos RMIS product suite. Drawing from our repository of total cost of risk (TCOR) management intellectual capital, we provide our suite of data benchmarks, scorecards, and AI-driven predictive analytics to deliver the actionable information required to drive superior claims outcomes.

Holistic perspective of program performance and outcomes

We understand the importance of real-time monitoring of changes in your risk profile and the impact it has on your TCOR. Key to the design of Luminos is a holistic perspective of program performance along with accurate information about outcomes. That's why we offer our clients the ability to integrate their information into the core RMIS features to better monitor their unique programs and manage their risk effectively.

As the industry's trusted claims and risk management partner, Gallagher Bassett supports your business with the following:

- A digitized and secure cloud solution that accommodates easy global collaboration

- Real-time data on the performance of risk programs, allowing you to identify opportunities, develop suitable strategies, and monitor outcome improvements

- Data benchmarks, assessment tools, and AI-powered analytical models to deliver relevant data to help lower the cost of risk

- A comprehensive suite of configurable dashboards and reporting capabilities.

RMIS tool product suite

Our RMIS offers flexible computing technologies with superior data management tools and cutting-edge analytics. It comes bundled with our claims and risk management services and includes comprehensive training and support. Some of the features include:

- Dashboards: Use standard templates, custom builds, and interactive analytics to track program performance

- Inquiry: See data by loss, incident, or claim to better target specific opportunities for performance improvement

- Reports: Use standard libraries, ad hoc report writers, or scheduling packages to align reporting with your organization's needs

- Hierarchy: Sort, manage, and view assets by location structures or exposure values

- Workflow and Monitoring: Set alerts or assign tasks to collaborate and supercharge your risk management team.

Luminos expanded services

Expanded services can be incorporated as bolt-on feature-sets for extended RMIS platform functionality and holistic program management, or they can be bundled in packages (e.g., industry-specific, similar feature-set streams). Some of the features include:

Within our Luminos RMIS product suite, clients can merge historical self-administered claim data with current claim financials to enhance the statistical accuracy of their risk program analytics. Integrating this data provides a more comprehensive view of claim information sets that can factor into risk management decisions and action plans.

A few examples of data sets and tracking capabilities include:

- Adding notes, photographic images, and relevant documentation to self-handled general liability claims

- Managing all relevant employee, accident, and vehicle information for auto liability claims

- Tracking subrogation applicability for all self-insured claims.

This service allows clients to electronically transmit FROIs directly into Gallagher Bassett claim adjudication systems and manage all relevant accident and employment information for near-miss and incident reports in one place. Features include:

- Adding notes, photographic images, and relevant documentation

- Tracking investigative findings

- Noting corrective action recommendations, tasks, and completion dates to ensure that potential injury sources are eliminated before accidents occur.

This tool helps clients ensure their facilities comply with National Fire Protection Association (NFPA)® 101, applicable build codes, and local ordinances by simplifying the management of life safety audits, including information collection and regulatory compliance details. Features include:

- Tracking audit timeline completion dates, the required documentation submissions, and remediation task completions

- Merging audit data, accident histories, and applicable claim data for holistic views into your TCOR program

- Implementing audit process improvements.

Our Luminos RMIS data repository gives clients finger-tip access to diverse EHS information sets for a full view of program performance in one place. Features include:

- Generating Occupational Safety and Health Administration (OSHA) 300 and 300A logs

- Uploading historical air emission and ambient air quality readings to enhance the statistical accuracy of annual trend analytics

- Tracking physical property, chemical, and biological hazard safety audit results

- Consolidating environmental spill data sets

- Reviewing training completion certifications.

Keep disparate property management data in one location for more effective internal data collection strategies and better analysis of program performance. The ability to share comprehensive organized data with broker partners also aids with efficient policy renewal efforts. Data sets include, but are not limited to:

- Required building construction class codes, occupancy types, and property square footage

- Payroll dollars, fleet industry classification types, and business use classes.

This tool helps clients track OSHA recordable incidents with our integrated adjudication data for better recordkeeping and compliance at the individual claim and aggregate levels.

At the aggregate level, clients can:

- Automatically generate required log Forms 300 and 300A to support inspection requests and annual filing requirements.

At the individual claim level, clients can:

- Track initial disability dates, applicable recordability criteria, and required OSHA codes

- Add separate accident detail notes, document applicable treatment information, and track the number of lost workdays.

Luminos RMIS can function as a real-time input portal for risk management program data and documentation. Some of the capabilities and functionality include:

- Providing employees with tablet-based Life Safety Code® survey audit data management forms

- Accommodating remote building Construction Occupancy Protection Exposure (COPE) data entry to streamline policy renewal and appraisal activities

- Uploading on-scene photographic evidence and accident observations with any online mobile device

- Remotely reporting investigative root cause analysis details.

On an aggregate level, clients can:

- Review existing program coverage details by carrier and dollar thresholds, easily identifying any potential gaps that could result in a catastrophic financial loss

- Manage counterparty exposures for both participating carriers and applicable policies.

At the individual policy level, clients can:

- Manage all relevant financial data, including premiums, deductibles, and fees

- Track named insureds, underwriting paper companies, and perils/exclusions

- Check policy erosion figures with Gallagher Bassett claims data integrated into the Luminos RMIS.

Luminos allows clients to streamline all fleet management information in a single computing tool — a bonus for annual policy renewal efforts. Tool capabilities include, but are not limited to:

- Easily managing all relevant vehicle information, regulatory compliance details, and applicable maintenance activities

- Tracking driver information, routine repairs, and accident histories.

With a single Luminos RMIS data repository, clients can access disparate information sets to improve overall productivity and organizational agility for better ERM outcomes.

At the macro level, clients can:

- Flowchart risk processes to see connections and interdependencies

- Define governance activities

- Monitor follow-up tasks and model changes throughout the year.

At the individual risk level, clients can:

- Manage all relevant ownership and appetite data

- Set and track change velocity and vulnerability ratings

- Edit action plans.

Integrations and consolidations

Luminos supports simple access to diverse information sets that support all TCOR deliberations. Examples include:

- Merge historical claim data with current claim financials to enhance the statistical accuracy of annual trend analytics

- Upload relevant policy data to accurately calculate current erosion statistics

- Incorporate Short-Term Disability (STD), Long-Term Disability (LTD), and Family Medical Leave Act (FMLA) information to support employee outage planning and analysis

- Consolidate product recall and environmental spill data sets into analytics.

Attachments

Luminos makes data collection and management easy with the ability to upload various types of documentation. Examples include:

- Upload accident investigation photographs, consolidate relevant video files, add client notes, and centrally store relevant post-accident audio interview files

- Attach building appraisal Microsoft® Word documents

- Integrate all risk program trend analysis Excel spreadsheets into your RMIS data

- Add life safety audit photos to back up NFPA 101® compliance reviews

- Electronically store policy documents

- Manage historical OSHA 300 and 300A log files for future reference.

Cost of Risk Allocation Management

The Luminos RMIS allocation module helps clients analyze custom metrics. Examples include:

- Specific per-claim charges over a dollar total-incurred threshold

- Performance-based metrics, such as injured worker return-to-work statistics, managed care PPO utilization numbers, and claim counts

- OSHA recordable totals and insurance premium dollars

- Headcount totals, business unit sales dollars, and miles driven by applicable vehicle fleets.

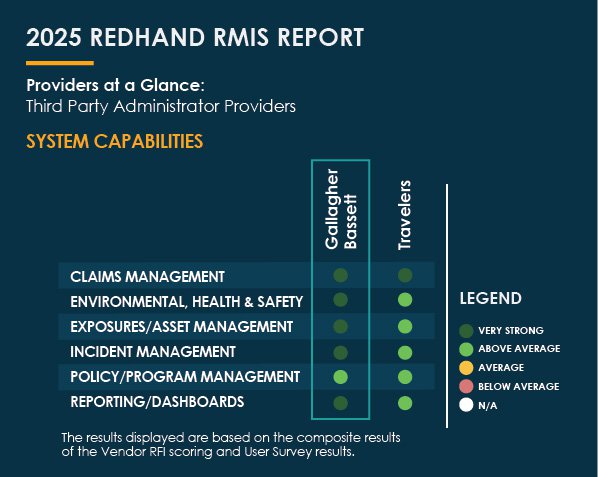

Luminos named "most comprehensive product offering in the space" for the eighth time

For the eighth year in a row, the 2025 RMIS Report called out Gallagher Bassett's Luminos platform as the most comprehensive product offering in the bundled TPA space.

Published by respected industry veterans Patrick O'Neill and David Tweedy, the report includes feature-set evaluations, client survey results, and functionality commentary.

Covering all bundled and unbundled RMIS system options for the risk management community, the Report is the definitive guide for independent computing RMIS tool reviews.

Case study: Leveraging Luminos to automate global data unification

Find out how our team assisted a well-known retail/restaurant organization client to successfully manage their insurance policy renewal programs by:

- Simplifying global data value collection cycle times

- Reducing risk management staff's manual consolidation efforts

- Automating data distribution.

This is a 5++. Luminos is excellent and meets my ever-changing reporting needs. I couldn’t do my job without it.

Make Gallagher Bassett your partner for data analysis and risk program management

Learn how Luminos, the highest-ranked RMIS in the industry, can help you track outcomes for better analysis, benchmarking, and ongoing program improvements.