By: Joe Powell

February 22, 2023 — Driving action through analytical insights continues to be a priority across the Insurance industry, encouraging both risk managers and carriers to tap into new capabilities that drive operational efficiency in claims programs. Benchmarking is crucial to a successful claims operation, but the approach the industry has taken over the years has varied in efficiency and relevance.

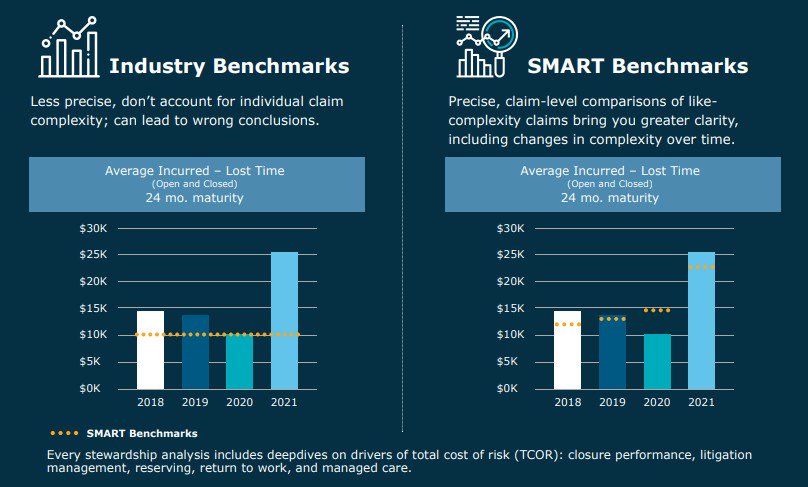

Relying solely on industry benchmarks to inform your claims management can mislead key strategic decisions. Most benchmarks rely on industry-specific comparisons, including vastly different exposures at the claim level, even in the same jurisdiction. Moreover, inaccurate information and data can have significant negative impacts on your claims programs and total cost of risk.

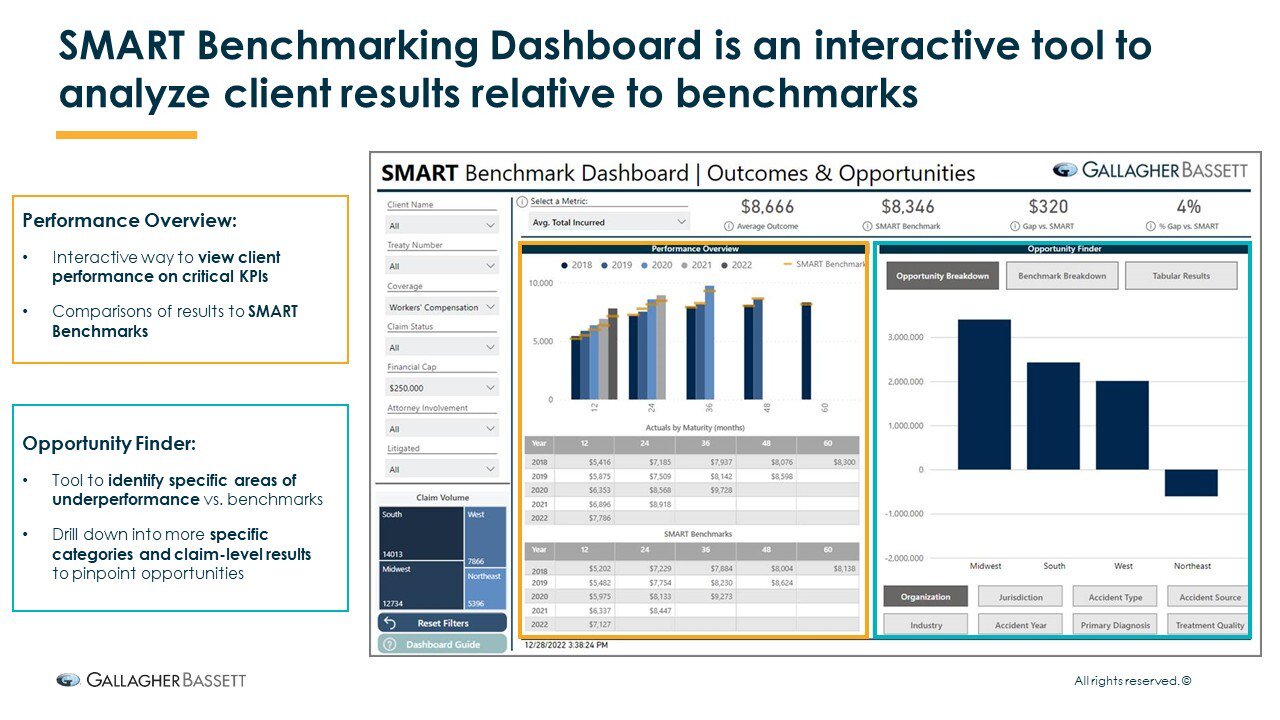

In 2016, Gallagher Bassett introduced a new approach to benchmarking claim outcomes, called SMART (Severity Mix Adjusted Rating Technique), whereby each client's individual claims are compared to hundreds of other claims of like complexity, factoring in variables such as accident type, jurisdiction, job class, medical procedures, diagnoses and many others. The benefit of this approach is a more meaningful basis for comparison and more precise benchmark, which provides clarity in terms of where opportunities exist and thus where to focus. This year, GB is thrilled to launch our newest Luminos enhancement, SMART Benchmarking Dashboard, offering unparalleled data insights into your claims management performance.

We built the SMART Benchmarking Dashboard to allow our clients to interactively drill down into root cause of opportunities in real time, across more than a dozen metrics, effectively creating a 24/7 stewardship. For example, a client might find that their overall costs have increased in the past year. From there, they can quickly see where that cost increase has come from using the 'Opportunity Finder' feature, which slices outcomes by business division, jurisdiction, accident type and source, industry, and even medical treatment quality. Each driver of opportunity is quantified relative to the SMART benchmark, allowing clients to easily prioritize which drivers to focus on to improve outcomes.

Benefits of SMART Benchmarking:

- Improves accuracy of claim range and helps to provide clarity into what can reduce the total cost of claims

- Delivers a systematic comparison based on dozens of claim characteristics to increase cost saving opportunity

- Reduces error rate of claim range by incorporating unique business details and claim characteristics

- Creates targeted recommendations on where to focus efforts toward proactive program improvement

- Provides in-depth detail on year-over-year claim trends to help you make better, more informed decisions about your business

- Helps focus attention and time investment on claims that are most likely to have a severe business impact

Industry-based benchmarks can lead to the wrong conclusions as they are less precise and do not account for individual claim complexity. SMART Benchmarking provides precise, claim-level comparisons to deliver greater clarity, including changes in complexity over time. And now, with the introduction of our SMART Benchmarking Dashboard, clients will have real-time access to their claims outcomes in the most transparent, most dynamic format available, bar none.

To learn more, watch the short video below and explore the benefits SMART Benchmarking could add to your claims programs in 2023.

Author

Joe Powell

Make Gallagher Bassett your dependable partner

When making the right decision at the right time is critical to minimize risk for your business, count on Gallagher Bassett's extensive experience and global network to deliver.